How To Find the “Best” Reverse Mortgage Lender

Mike Branson Jr. – Author

Mike Branson Jr. has 25 years of experience in the mortgage banking industry. He has devoted the past 19 years to reverse mortgages exclusively. Mike has worked in several aspects of the Mortgage industry, including Loan Origination, Underwriting, and Management.If you’ve decided that a reverse mortgage is right for you, the next step in your journey is to seek a reverse mortgage lender to complete your loan.

We hope this guide helps you in your search and offers some essential tips for narrowing down the right reverse mortgage outfit for you.

First, check what past customers are saying.

Our first piece of advice is to do your homework and check prospective lenders’ references.

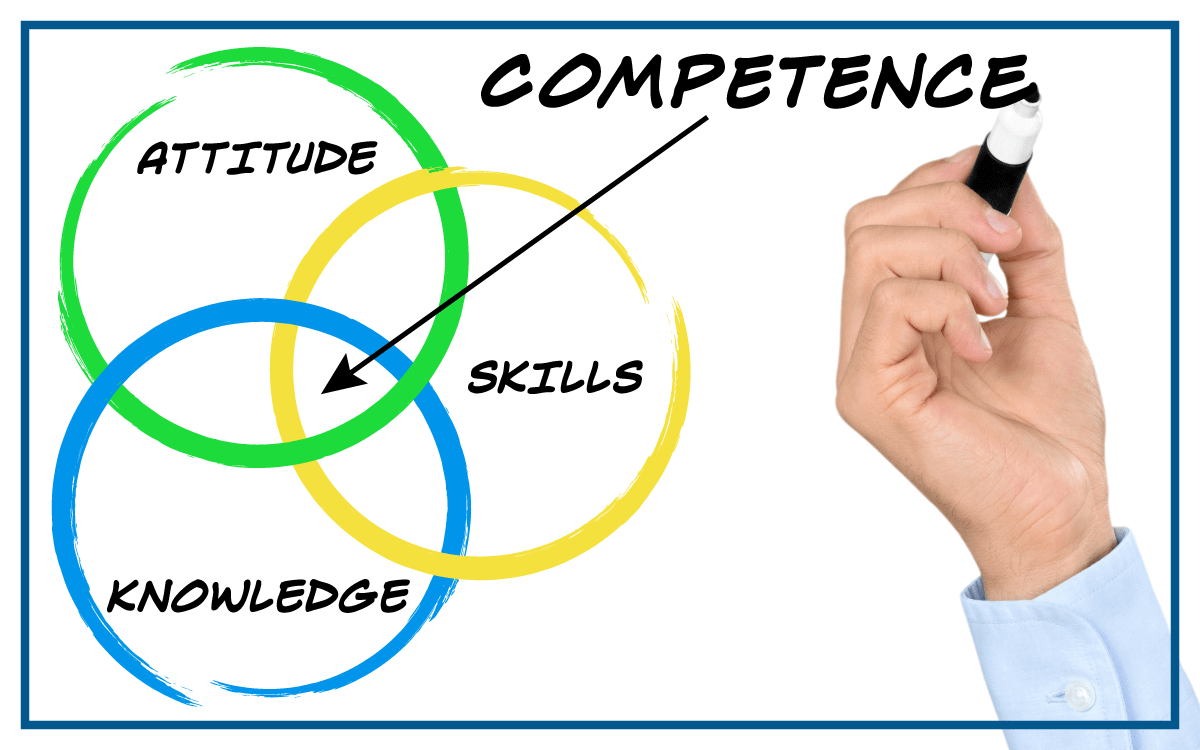

There are a lot of loan officers who were originating a different product just a year ago, have been working for 5 different companies over the past 12 months, or whose company closes every loan type under the sun, and reverse mortgages are a side product or?oh well, you get the idea. Reverse mortgages are a very specific and specialty-oriented loan program.

If you are not a reverse mortgage specialist, you are probably unaware of all the HUD requirements. Your originator and the company they work for should specialize in reverse mortgages.

Check online rating agencies where originators cannot manipulate or “buy” ratings. There are a lot of so-called rating sites that are not real. They are owned by companies looking to capture your information and sell it to other loan originators, and people can pay for positions or rankings on these sites.

TIP: Choose bona fide consumer sites that lenders and originators cannot flood with their own comments nor manipulate the rankings by buying advertising on the site.

Choose sites like Better Business Bureau (BBB) and Google to research possible lenders.

Next, compare, compare, compare.

Suppose a lender will not write a proposal to you or will only do so after you supply them with personal information, such as your social security number. In that case, we recommend you look for a different lender.

Some lenders are afraid to have you compare their pricing and programs to others and try to escape putting anything in writing that you can use to see exactly how they stack up to the competition. Still, others will refuse to do so until you give them your social security number.

A lender does need some information to give you an accurate quote but no more than the month and year of each borrower’s birth (don’t even need the exact birthdate if you do not wish to give it for the initial quote), the zip code where the property is located, the approximate value of the home (which the lender should validate with current sales any way) and the amount you owe on any existing loans/liens on the property.

That is all any lender needs for a quote, including eligibility, closing costs, and interest rates. If you have credit issues (especially mortgage, taxes, or insurance delinquencies in the past 24 months), you must let your lender know immediately).

Still, the lender does not require your social security number or need to run your credit for an initial proposal. Once you have two or three proposals, you can compare all aspects of the loan terms to determine which suits you and be sure the terms you are comparing are the ones that really count in your circumstances.

Some lenders like to discount a fee such as an appraisal to make it look more attractive, but after you compare all other terms, that $100 – $150 you saved on the appraisal fee costs you thousands or tens of thousands more on additional fees and interest!

Do not let any one item blind you to the entire package (and you may be able to get other lenders to offer concessions to overcome that $100 anyway).

Make sure the lender is working for you.

The loan is all about you and your needs.

The lender should send you the programs and options that you need, not that they want to “sell” you. A good originator will listen to what you tell them and may suggest different options based on your comments about your goals but in the end, the object should be to line you up with the loan that best meets your needs and goals.

If you feel that no matter what you tell the originator, he or she keeps trying to talk you into something you don’t want, that is not the right lender for you. Your lender should help make suggestions based on what you tell them are your goals with the loan and why they feel the way they do, but in the end, it is your call.

If your goal is to preserve as much equity as possible and the originator is trying to talk you into taking all the funds from the first draw, that would be bad advice. If you want the funds for a specific purpose but the originator pushes you to take a monthly payment, that isn’t their call.

Your lender should look out for your best interests.

Borrowers sometimes run into this behavior with counselors, which is not their job either. A counselor should tell you about the loan and how it works, answer any questions, and let you decide which program best suits your needs ? not push their preferences on you. Your loan officer should do the same.

He or she should tell you all about the program and how the different options will affect you and answer your questions but not try to steer you to any specific programs or options unless you ask.

Originators are forbidden by law to give accounting or legal advice, so your originator should offer information about the loan but not your taxes, legal implications, or financial planning.

They can tell you about information other borrowers have given or things they have read. Still, they must advise you that they cannot tell you how that would work for you and that you should verify with your accountant, attorney, or trusted financial advisor.

If you run into a lender trying to tell you how to file taxes, financial schemes you should employ with your funds or other such information, we advise you to seek the services of a new loan originator.

5 Tips:

- Check prospective lenders’ references and online ratings on trustworthy sites like BBB and Google to gauge their expertise in reverse mortgages.

- Compare proposals from multiple lenders, focusing on eligibility, closing costs, and interest rates without giving them your social security number for the initial quote.

- Ensure the lender prioritizes your needs and goals, providing you with the programs and options that best suit your preferences.

- Lenders should not push their preferences on you, instead focusing on explaining the programs and answering your questions.

- Avoid lenders who provide accounting, legal, or financial planning advice, as they are legally forbidden from doing so; consult professionals in those fields instead.

|

No Comments on “How To Find the “Best” Reverse Mortgage Lender”

|