Reverse Mortgages Come with Upsides & Downsides

Mike Branson Jr. – Author

Mike Branson Jr. has 25 years of experience in the mortgage banking industry. He has devoted the past 19 years to reverse mortgages exclusively. Mike has worked in several aspects of the Mortgage industry, including Loan Origination, Underwriting, and Management.So, you’re thinking about getting a reverse mortgage, but you’re not sure how the product will work best for you. Maybe you’re hearing the downsides of the loan along with the upsides.

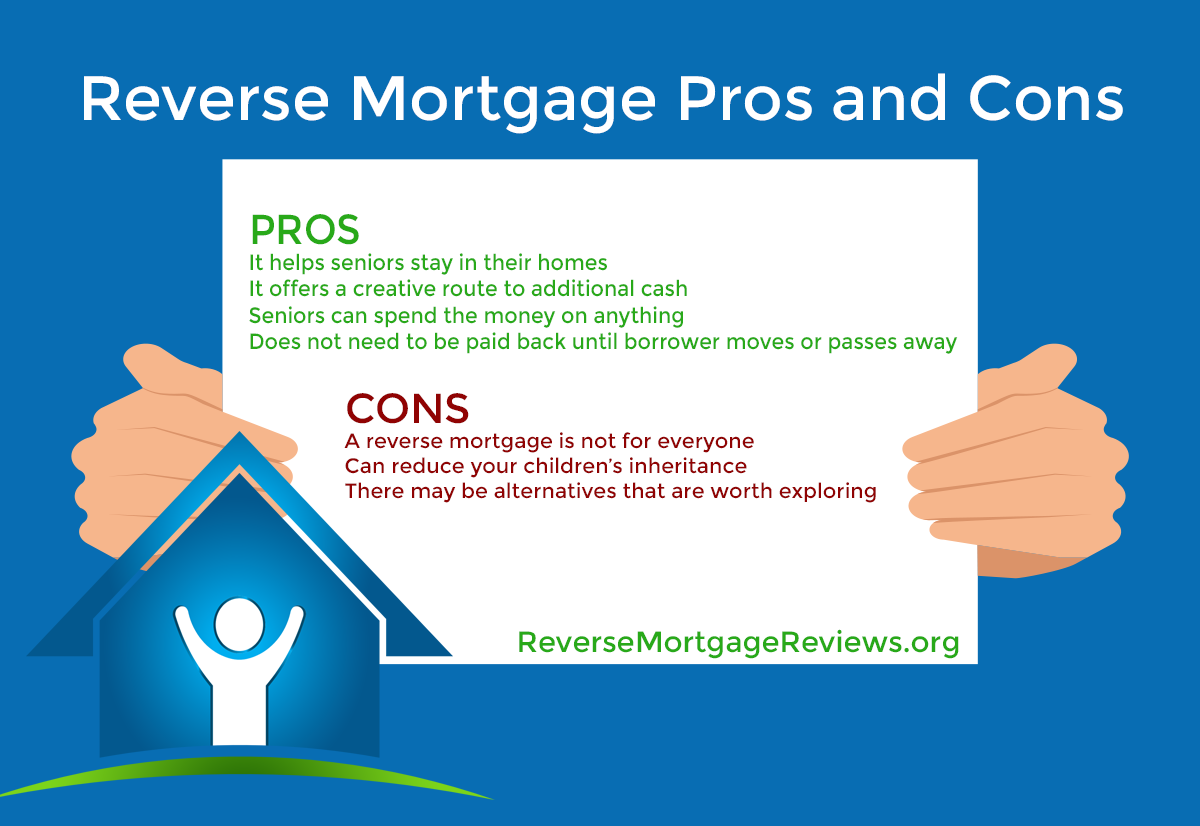

Here is a look at the pros and cons of a reverse mortgage.

Reverse Mortgage PROS/Upsides

Pro: It helps seniors stay in their homes.

While there are several reasons to access a reverse mortgage, among the best known is the opportunity the product presents to fixed-income seniors seeking funds for their basic needs. For this population, being forced to sell a lifelong house can be a decision that is both emotional and financial. Versus the cost of moving into an assisted living facility, it can also be the least expensive setting in which to receive care, should that need arise down the road.

Pro: It offers a creative route to additional cash.

Not everyone who pursues a reverse mortgage is in a financial bind. Increasingly, astute borrowers are recognizing the economic advantages of taking out a reverse mortgage. Because the money can be used for anything (see below), some borrowers are turning to reverse mortgages to fund tangible items, such as home remodeling or travel, while others are simply using it to access, as needed, a line of credit.

Pro: Seniors can spend the money on anything.

While most seniors who get a reverse mortgage will spend the money on basic needs, such as health care, no restrictions exist governing how a borrower spends his or her reverse mortgage proceeds. That means a reverse mortgage is a tailor-made loan that can help seniors live better lives. For a full list of requirements of how to access a reverse mortgage, go to the Department of Housing and Urban Development (HUD),

Pro: The loan does not need to be paid back until the borrower moves or passes away.

This is as basic as it gets. Many retired homeowners over the age of 62 reach a point in life where they need more money than their fixed income will allow. One option is to access a home equity loan or home equity line of credit, but these options come with their own pros and cons; they can be difficult to qualify for, and they often have near-term repayment plans. A reverse mortgage, meanwhile, does not need to be paid back until the borrower is either out of the property for 12 consecutive months, or passes away.

What are the downsides?

Con: A reverse mortgage is not for everyone.

Just because a homeowner is age 62 or older and wants more money does not mean a reverse mortgage is right for them. For one thing, while borrowers can use a reverse mortgage to satisfy a range of purposes, its foundational function is to help seniors remain in their homes. Therefore, a homeowner who does not plan to remain in their home might not want this product. Additionally, the borrower in question should not merely want to remain in his or her home, but should be able to.

‘Using a reverse mortgage to fund an in-home caregiver might be worthwhile, but some seniors are simply unable to remain in their homes safely, even with an influx of cash, due to mobility needs or other repairs or maintenance that are not practical to attain.

Con: A reverse mortgage can reduce your children’s inheritance.

As stated above, a major selling point of the reverse mortgage is that the loan does not need to be repaid until after the borrower dies or moves from the house permanently. But the inherent flip side is that once the borrower is out of the house, the loan must be repaid. In many cases, the borrower’s estate will repay the loan through the sale of the home. However, in situations where the family wishes to keep the home, they must repay the loan through other means.

Con: There may be alternatives that are worth exploring.

Here at ReverseMortgageReviews.org, we specialize completely in the HUD-backed Home Equity Conversion Mortgage, or HECM Lender Reviews. This is a government-insured, eminently popular loan ? it’s so popular, in fact, that more than 99% of the reverse mortgage loans closed today are HECMs.

Con: Reverse mortgages do come with upfront costs.

While many of the fees associated with reverse mortgages, such as closing costs and fees, are akin to those a borrower would face in taking out a forward mortgage or alternative product, HECM loans also carry required mortgage insurance provided by the Federal Housing Administration.

This insurance comes with an upfront cost as well as an ongoing cost throughout the course of the loan. While the insurance provides protections and benefits, such as the HECM’s non-recourse feature, there may be alternatives, such as downsizing, that are worth exploring.

Summary

When researching a reverse mortgage, it’s important to speak to your family and trusted financial advisor to weigh both the pros and cons. Learn more about how a HECM loan might be right for you by contacting one of our top reverse mortgage lenders or check your eligibility with our free reverse mortgage calculator.

|

2 Comments on “Reverse Mortgages Come with Upsides & Downsides”

|

-

Admin July 18, 2023 Debi L.July 18, 2023 I'm looking for a credit with a lender paying to close. I owe $44k .. (property worth $265K but )selling for 190k .., so the property is worth 190k. I'm single and 65. In a couple of weeks. I'm not a big fan of reverse mortgages, and I would likely pay it off or substantially pay it down within a year. It is the best alternative for my situation today.