6 Key Challenges of Reverse Mortgages in 2025

Mike Branson Jr. – Author

Mike Branson Jr. has 25 years of experience in the mortgage banking industry. He has devoted the past 19 years to reverse mortgages exclusively. Mike has worked in several aspects of the Mortgage industry, including Loan Origination, Underwriting, and Management.The reverse mortgage is a great product. But like all products, it is not a fit for every consumer. And while the product brings many advantages to aging homeowners, there can also be downsides depending on the prospective borrower's situation.

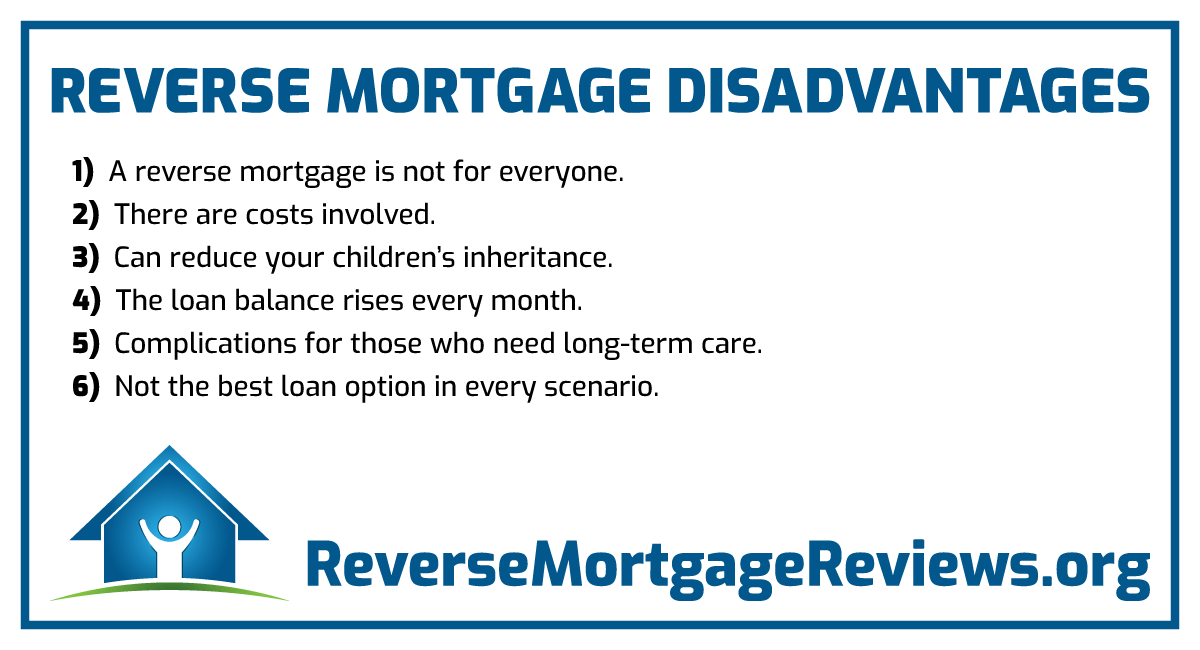

Here is a look at six reverse mortgage disadvantages to weigh if you are considering a home equity conversion mortgage (HECM) loan.

1. A reverse mortgage is not for everyone.

A reverse mortgage is a loan for homeowners aged 62 and over, allowing them to borrow against home equity. This explains its name: instead of a regular mortgage, where a person borrows money to buy a house, a reverse mortgage lets them borrow money from the house they already own.

Yet just because a homeowner meets the eligibility requirements and wants to capitalize on a reverse mortgage's various benefits does not mean the product is right for them. For one thing, while borrowers can use a reverse mortgage to satisfy a range of purposes, its foundational function is to help seniors remain in their homes.

Therefore, a homeowner who does not plan to remain in their home might not want this product. Additionally, the borrower should not merely want to remain in their home but should be able to.

Using a reverse mortgage to fund an in-home caregiver might be worthwhile. Still, some seniors cannot remain in their homes safely, even with an influx of cash, due to mobility needs or other repairs or maintenance that are not practical to attain.

2. There are costs involved

A senior who wants to convert a portion of their home equity into cash may be suitable for a reverse mortgage. The product can be a good resource for some prospective borrowers, but the loan does require financial commitment, even if it does not require monthly mortgage payments.

Specifically, the borrower must pay property taxes and mortgage insurance and maintain the upkeep of the property. That means a borrower must have access to enough funds independent of the reverse mortgage to afford the reverse mortgage.

In other words, a reverse mortgage won't eliminate home-related expenses and thus might not be the best option if the borrower's cash flow is minimal.

3. A reverse mortgage can reduce your children's inheritance.

A central selling point of the reverse mortgage is that the loan does not need to be repaid until after the borrower dies or moves out of the house permanently. However, the inherent flip is that the loan must be repaid once the borrower leaves the house. The borrower's estate will often repay the loan by selling the home.

However, when the family wishes to keep the home, they must repay the loan through other means.

4. The loan balance rises every month.

One of the major selling points of a reverse mortgage is that the loan does not have to be repaid until the borrower is permanently out of the house. This makes it an ideal product for many seniors intent on aging in place.

The downside to a reverse mortgage is that while the balance on an average loan declines each month, the balance on a reverse mortgage increases each month. This distinction is irrelevant mainly because the loan must not be repaid until the borrower leaves the house.

However, if something goes wrong and a borrower does not meet the loan's obligations, the lender can call the loan due, leaving the borrower in a huge hole.

5. A reverse mortgage can cause complications for some borrowers who need long-term care.

Many borrowers who take out a reverse mortgage intend to stay in their houses for the rest of their lives. However, borrowers who reach a point where they need to move into a long-term care facility might have to sell their house before they want to.

So, if a borrower seems on pace to enter a long-term care facility, simply accessing a reverse mortgage won't keep that person in their home.

6. A reverse mortgage is not the best loan option in every scenario.

Reverse mortgages do come with upfront costs. While many of the fees and interest charges associated with reverse mortgages, such as closing costs and fees, are akin to those a borrower would face in taking out a forward mortgage or alternative product, HECM loans also carry required mortgage insurance provided by the Federal Housing Administration.

This insurance comes with an upfront and ongoing cost throughout the loan. While the insurance provides protections and benefits, such as the HECM's non-recourse feature, there may be alternatives, such as downsizing, that are worth exploring.

1. If you intend to leave your home as the most significant possible asset to heirs, you will be using your equity, and therefore, it will be lower when the home is sold.2. You must continue to live in the property as your primary residence so if you plan to rent your home at some point, a reverse mortgage will not allow this option.

3. Because the loan is FHA-insured, there is mortgage insurance, and the fees can be high. Most of the fees are financed, but some are paid up-front, so you need to talk to your lender about the total fees and what must be paid in advance (out of pocket) for things like counseling and appraisal.

The reverse mortgage is due and payable if the borrowers are no longer living in the property as their primary residence (as would be the case if they move) or sell the home. However, the borrowers can pay the loan off at any time they wish without penalty. This could be true if they wanted to gift the home to family members (those individuals would most likely obtain their financing, and the reverse mortgage would be paid in total), if the borrowers wanted to refinance the loan with another type of financing, or the borrowers can pay off the balance if they suddenly have cash they did not expect (i.e., an inheritance or insurance payout). Still, the loan is repaid, and there is never a prepayment penalty.

The most common ways a reverse mortgage is repaid when it is not with another reverse mortgage (refinance) is from the death of the borrowers and the sale of the home by the heirs or the loan foreclosed by the lender so that the lender can sell the property if the heirs do not wish to try to sell it (or there are no heirs).

The reverse mortgage is intended to be the last loan you will ever need. If, even after the reverse mortgage closes, you are not comfortable and able to meet your monthly obligations, or if your home no longer meets your needs, you should consider selling your home and moving to a new home. At the same time, your equity is high instead of getting a reverse mortgage. If the loan does not allow you to remain comfortably in a place you love, there is no reason to delay the inevitable need to move. If the home is too much for you to maintain anyway, it may not be the right choice. If you can no longer use the house because it is two-story with all bedrooms upstairs and you cannot climb stairs, it may not be the right choice.

If the utilities are incredibly high and you know there are many things that either need attention or will soon because it is an older home. You barely meet the requirements to get the loan now; maybe a newer, smaller home would be better for you now while you have good equity and can use the reverse mortgage purchase program to buy an energy-efficient home.

If you know, you will need help soon and are far from family. Perhaps you should consider relocation to put you closer to support before you begin to use your equity. If you put off what you will need to do at some point anyway, you will do it later with less equity in your home and fewer options.

If the reverse mortgage allows you to live comfortably in the place you have come to know and love, it is doing its' job, but if it doesn't, you need to make that decision and make other plans sooner rather than later.

The reverse mortgage is a loan; like any other loan, the borrower still owns the property. You can sell your home any time you wish. The loan has two Deeds of Trust and two Notes so that if HUD needs to advance funds, they will be covered as well, and the amount that is recorded is for 150% of the property value or the HUD lending limit, whichever is less. So, it appears that the loan amount is very high, but remember, it can continue to rise if you never make any payments and borrow against your line of credit. For this reason, HUD does not know where the loan amount will stop since they do not know how long you will have the loan or how much you will borrow against it, and they do not want to limit you.

But you only owe what you borrow plus the fees to set up the loan and any interest that accrues (and, of course, any money they need to advance on your behalf, if any). So, it may not be uncommon in higher value areas to have a Deed recorded for $800,000, but the borrower only owes $100,000 if that is all they borrowed with interest, and the $100,000 would be all they needed to repay when they sold the home. It is similar to any other credit line.

You may have a line of credit for one amount, but you only need to repay whatever the outstanding balance is when you repay the line. You can sell your property any time you wish and repay the loan, but there is never a prepayment penalty with a reverse mortgage.

Summary

When researching a reverse mortgage, you must consult your family and trusted financial advisor to weigh the pros and cons.

Learn more about how a HECM loan might be right for you by contacting one of our top reverse mortgage lenders or checking your eligibility with our free reverse mortgage calculator.

|

2 Comments on “6 Key Challenges of Reverse Mortgages in 2025”

|

-

Admin November 21, 2022 Thom MorrisNovember 21, 2022 I had a freind whose parents had their home paid off. Someone suggested a reverse mortgage - so his father took the bait - The home Value went from 400K down to 150K so now they had a mortgage payment of $800/month on the 150K difference - [ This may have been changed in the newer contracts] Their son moved in to help them out