2022 HECM Reverse Mortgage Limits Skyrocket to $970,800

Mike Branson Jr. – Author

Mike Branson Jr. has 25 years of experience in the mortgage banking industry. He has devoted the past 19 years to reverse mortgages exclusively. Mike has worked in several aspects of the Mortgage industry, including Loan Origination, Underwriting, and Management.With HUD loan limits increasing, do you still need a jumbo reverse mortgage in 2022? HUD just announced that for 2022 they will be increasing their loan limits for the reverse mortgage program known as the Home Equity Conversion Mortgage or HECM ("Heck-um") program.

This is nothing new, HUD looks at the average prices of homes nationwide to determine the loan limits every year but what is so different about this year is that with the large house price increase that most areas of the country saw over the past year and a half (and especially in 2021), HUD increased the HECM lending limit by the single largest increase in a decade.

Not since the economic stimulus meant to help spark the economy had we seen increases like the one that will take place in 2022 and the one that will take place in January is the result of the increase in housing prices, not an attempt to jolt a sagging market.

To illustrate this point, the chart below shows the HECM limits from 2008 forward (prior to this time, the HECM program used regional limits rather than one national limit and those were much lower). In 2009, the national limit raised significantly as a part of the National Recovery and Reinvestment Act.

The limit remained stagnant at $625,500 for eight years before its first modest increase of $10,650 in 2017 when the limit increased to $636,150. Between 2018 and 2021 though, the limit increased annually on the low of $39,075 and the high of $56,775 ? but constantly increasing.

And then the explosion of property values shot the lending limit up by $148,425 in 2022 to the new limit to go into effect on January 1, 2022, of $970,800.

| Year | HECM Lending Limit |

|---|---|

| 2008 | $417,000 |

| 2009-2016 | $625,500 |

| 2017 | $636,150 |

| 2018 | $679,650 |

| 2019 | $726,525 |

| 2020 | $765,600 |

| 2021 | $822,375 |

| 2022 | $970,800 |

So, what does this really mean for borrowers?

It means a couple of things. Homeowners with houses valued up to about $1,100,000 can now receive about the same amount of money on the HUD HECM program in most instances than they can by using a jumbo program. Just a few short years ago, we were telling borrowers that the breakeven point was somewhere around $900,000 value but not anymore.

Because the HUD program has lower interest rates and typically gives borrowers more money as a percentage of their home's value with their loan, it often makes more sense to use the HECM product than a jumbo or proprietary loan even when the HECM loan caps the lending limit below the actual property value. See the chart below for an example of what we are saying here.

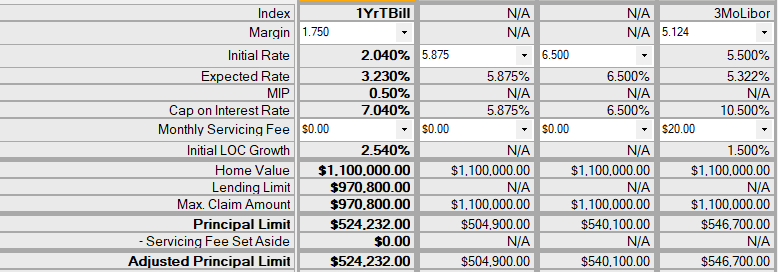

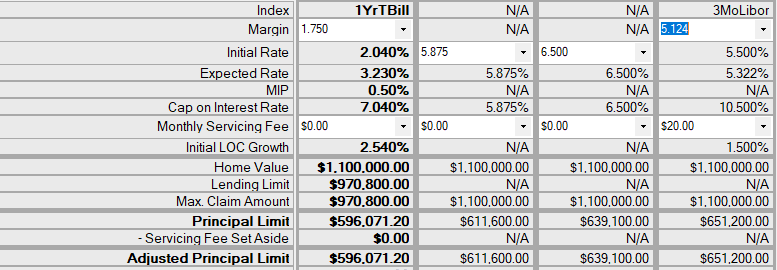

Comparing HECM to Jumbo Reverse Mortgages in 2022

We have illustrated the amounts a borrower receives for a borrower aged 65 and a borrower aged 78 for the HECM and jumbo loans for a property valued at $1,100,000. As you can see, the HECM loan gives borrowers really close to the same proceeds. But notice the interest rates and closing costs on the loans.

The HUD HECM program has an initial rate of right around 2.04% and a 7.04% life cap while the Jumbo adjustable-rate loans run about 5.5% with a 10.5% life cap. The HUD HECM loan will give borrowers almost the same funds for tens of thousands of dollars less in accrued interest over the life of the loan.

The Jumbo fixed rate loans will give borrowers access to more money initially (especially if all the funds are not needed for the payoff of an existing loan) but they also require borrowers to take a full draw of the funds and that means that borrowers accrue interest on the full amount from the very start. And the Jumbo adjustable loans only have a draw period of 10 years.

The loan remains in effect for as long as you live in your home but after 10 years you can no longer draw on the line of credit whereas with the HUD HECM line of credit, your line of credit grows annually at the same rate as your interest accrual (plus the mortgage insurance accrual of .5%) and you can continue to draw for as long as you remain in the property, you have money left on the line and you remain eligible (you pay the property charges in a timely manner and you live in the home as your primary residence).

Example: 65-Year-old Borrower

Example: 78-Year-old Borrower

Does this mean we are against the Jumbo programs?

Not at all. They work well for homeowners with properties valued at or over $1,200,000 (and for some borrowers, it pays to compare in some cases for more expensive homes depending on your goals).

We are just taking this opportunity to point out that the HECM lending limit increases have now opened some unique opportunities for many borrowers. You cannot get a payment for life (a tenure payment) with a jumbo loan, but you can with a HECM and if you have a more expensive property you may want to explore this again if you felt the old limits were too restrictive.

If you owe more than the old limits would pay off and therefore you did not close a reverse mortgage on your home valued at $970,800 or more, you may want to look at the program again. If you did close a reverse mortgage even though you knew you could use more funds, but you wanted the HUD program and "settled" for the lower amount, now may be a perfect time to refinance while the values are up, and the rates are still low.

With rising inflation, interest rates will most likely rise in the future. Now is a great time to obtain a reverse mortgage at a low rate and lifetime cap while still obtaining a loan at the new higher loan limits and the most available funds in the history of the program for borrowers with higher valued homes.

If you own a home worth over $1,000,000 or more, with the current opportunities for the HUD HECM product, you will have to decide if you need a jumbo reverse mortgage in 2022 or if the new HUD limits will meet your needs.

Summary

Learn more about how a Home Equity Conversion Mortgage (HECM) loan might be right for you by contacting one of our top reverse mortgage lenders.

|

No Comments on “2022 HECM Reverse Mortgage Limits Skyrocket to $970,800”

|