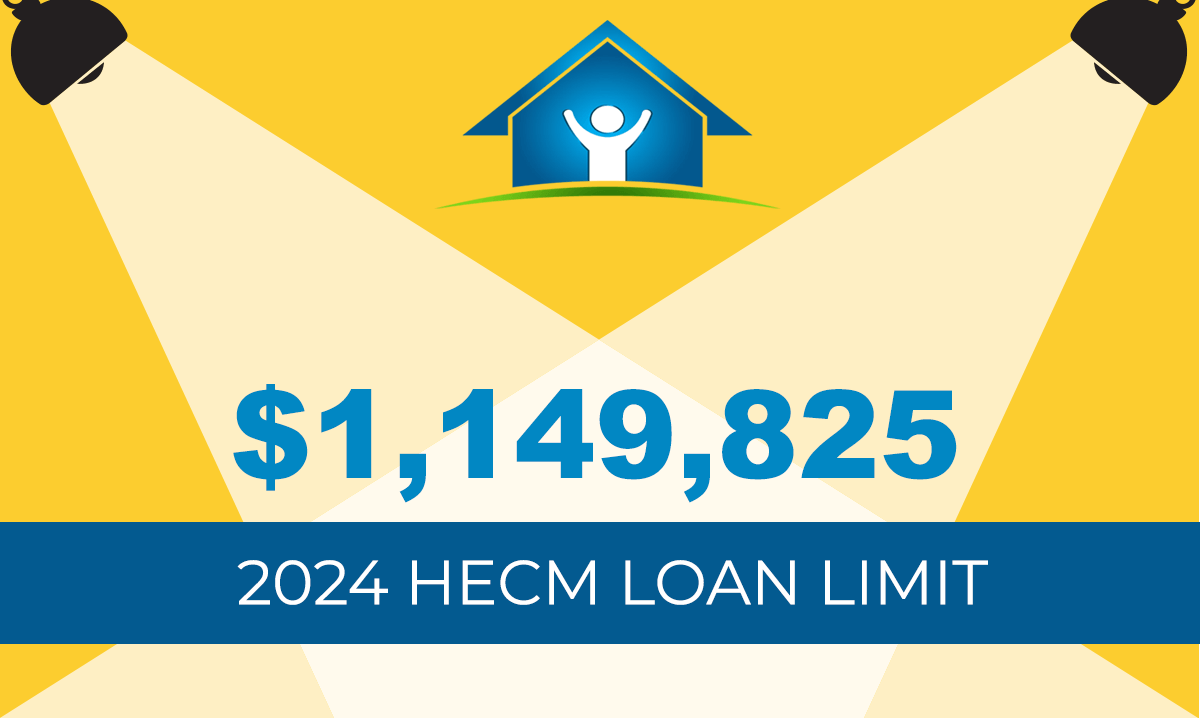

2024 HECM Limit Soars to $1,149,825: Boon for Seniors with High-Value Homes

Mike Branson Jr. – Author

Mike Branson Jr. has 25 years of experience in the mortgage banking industry. He has devoted the past 19 years to reverse mortgages exclusively. Mike has worked in several aspects of the Mortgage industry, including Loan Origination, Underwriting, and Management.

In a landmark decision that's set to impact the reverse mortgage market significantly, the Federal Housing Administration (FHA) has announced an upward revision of the maximum claim amount for Home Equity Conversion Mortgages (HECM) in 2024.

This change, which increases the limit from $1,089,300 to $1,149,825, will come into effect for case numbers assigned on or after January 1, 2024.

The revision affects the mainland U.S. and extends to Freddie Mac?s special exception areas like Alaska, Hawaii, Guam, and the Virgin Islands. This move, as outlined in Mortgagee Letter 2023-22, is set to be integrated into the forthcoming Single Family Housing Policy Handbook 4000.1.

Enhanced Opportunities for Seniors in High-Value Home Markets

This revision is particularly significant for seniors residing in high-valued homes. Reverse mortgages have long been a financial strategy for seniors, allowing them to convert part of the equity in their homes into cash without having to sell or move. The increased limit in 2024 means that more of their home equity is accessible, offering them greater financial leeway in their retirement years.

Understanding Reverse Mortgages

A reverse mortgage is a type of loan available to homeowners aged 62 or older, enabling them to convert a portion of their home equity into cash. The borrower isn?t required to pay back the loan until they move out or sell the home. The HECM program, insured by the federal government, is the most popular type of reverse mortgage.

Implications of the Increased Limit

- Increased Loan Amounts: Seniors can now access a larger portion of their home's equity, which is crucial in areas with high property values. This could mean additional funds for living expenses, medical bills, or even leisure activities in their golden years.

- Comparison with Jumbo Reverse Mortgages: The raised HECM limit provides a competitive alternative to jumbo reverse mortgages, traditionally sought after for high-value properties. The government-insured HECM offers added security and potentially more favorable terms than its private counterparts.

- Impact on the Housing Market: This increase is a response to the rising home values and reflects a robust housing market. It's a forward-looking move that acknowledges the current economic landscape and the needs of aging homeowners.

A Look at Historical Trends and Future Projections

The history of HECM lending limits is a tale of gradual and responsive adjustments to the housing market's ebb and flow. Notable increments over the years demonstrate the program's adaptability to changing economic conditions. For instance, the significant leap in 2009 to $625,500 as part of the Housing and Economic Recovery Act and consistent increases during the COVID-19 pandemic underscore the program's responsiveness to market dynamics. However, with fluctuating interest rates and potential market shifts, future adjustments to lending limits remain a possibility, necessitating ongoing monitoring and adaptation.

Analyzing the 2024 Limit Increase

This latest increase is one of the most substantial in recent years, signaling confidence in the housing market and offering more opportunities for homeowners seeking reverse mortgages. This change is particularly pertinent for seniors with higher-valued homes, as it allows them to unlock more of their property's value.

Navigating the New Landscape: Advice for Seniors

Given these changes, it's essential for seniors to seek advice from a qualified reverse mortgage lender. These experts can provide insights tailored to individual circumstances, helping seniors make informed decisions about leveraging their home equity.

5 Essential FAQs for Understanding the 2024 HECM Limit Increase

- What does the 2024 HECM limit mean for reverse mortgages? The new limit of $1,149,825 means a higher potential loan amount for seniors, allowing them to access more of their home equity.

- Is refinancing a reverse mortgage in 2024 a good idea? A reverse mortgage refinance could be beneficial if it results in more funds, but it's subject to specific qualifying criteria, like the 5x benefit tests.

- What determines the maximum amount of a HECM reverse mortgage? Factors include the age of the youngest borrower, the home's value, the HUD limit, and current interest rates.

- How is the HECM limit calculated? HUD determines the HECM limit based on 150% of Freddie Mac's national conforming limit.

- What factors affect the principal limit of a reverse mortgage? The borrower's age, the home's value or HUD limit, and prevailing interest rates are key considerations.

Summary

The 2024 increase in the HECM lending limit represents a significant milestone for seniors, especially those in high-value home markets. It opens up new avenues for financial planning in retirement, highlighting the importance of staying informed and consulting with experts. As the housing market continues to evolve, so too will the opportunities and considerations for homeowners exploring reverse mortgages.

|

No Comments on “2024 HECM Limit Soars to $1,149,825: Boon for Seniors with High-Value Homes”

|