Unlock Your Home's Potential: In-Depth Guide to HECM Line of Credit

Mike Branson Jr. – Author

Mike Branson Jr. has 25 years of experience in the mortgage banking industry. He has devoted the past 19 years to reverse mortgages exclusively. Mike has worked in several aspects of the Mortgage industry, including Loan Origination, Underwriting, and Management.Today's seniors are sitting on an incredible amount of home equity: more than $11 trillion. For many, it's their largest asset.

A HECM LOC lets older adult clients access that equity at a predictable growth rate, regardless of whether their home value increases or decreases. Borrowers with sufficient equity may have access to growth on their total credit facility.

Here are two examples with and without a mortgage balance:

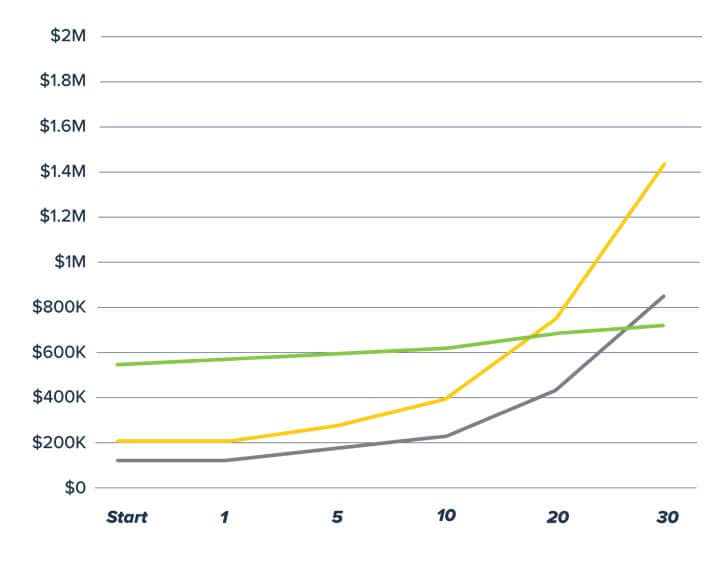

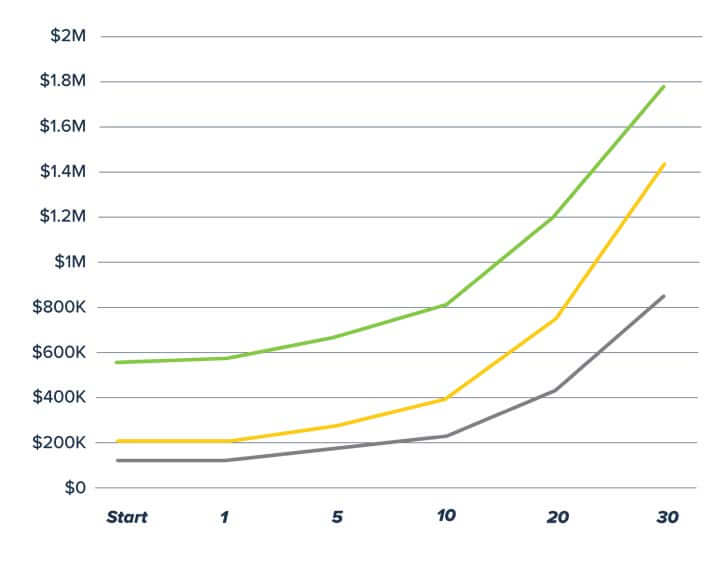

Example 1: HECM line of credit growth with a mortgage balance

- Home Value: $550,000

- Mortgage Balance: $100,000

- Age: 65

- Principal Limit: $207,900

- Financed Costs: MIP 2% of Home Value: $11,000 Max Origination: $6,000 3rd Party Fees $4,369.20

- Expected Rate: 5.98%

- HUD MIP: 0.5%

- LOC Growth Rate: 7.26%

- Outstanding Balance: $120,744.20

- Line of Credit: $87,155.80

4% Growth Rate Calculations:

| Start | Year 1 | Year 5 | Year 10 | Year 20 | Year 30 | |

|---|---|---|---|---|---|---|

| PLF | $207,900 | $221,779 | $287,202 | $396,753 | $757,157 | $1,444,946 |

| Outstanding Balance | $120,744 | $128,805 | $166,801 | $230,426 | $439,742 | $839,196 |

| Line of Credit | $87,156 | $92,974 | $120,401 | $166,327 | $317,415 | $605,750 |

| Home Value | $550,000 | $572,000 | $669,159 | $814,134 | $1,205,118 | $1,783,869 |

HECM Line of Credit:

Home Value | Principal Limit | Outstanding Balance

Average home appreciation assumed at 1%

Average home appreciation assumed at 4%

*Information shown for illustrative purposes only. Assumptions are (1) 65-year-old borrower; (2) NJ home valued at $550,000; (3) LOC will grow at the same rate as the interest, currently (7.260%) plus the annual mortgage insurance premium charged to the loan (0.50% of the principal) for the HECM CMT MCap5 Adjustable Rate Mortgage (ARM), which uses the 1-Year CMT plus a margin of 2.00%. Initial APR is 7.260% as of 07/12/2023, which can change annually. 5% lifetime interest cap over the initial interest rate. Maximum interest rate is 12.26%; (4) no draws by the borrower. Interest rates and funds available may change daily without notice.

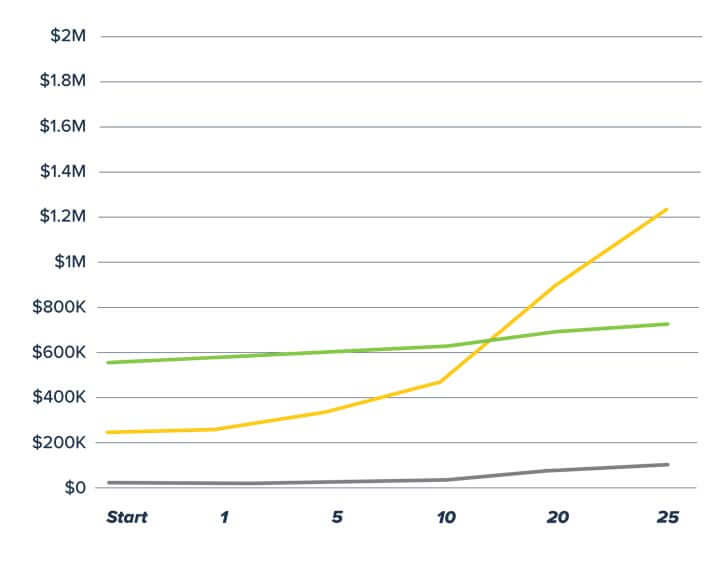

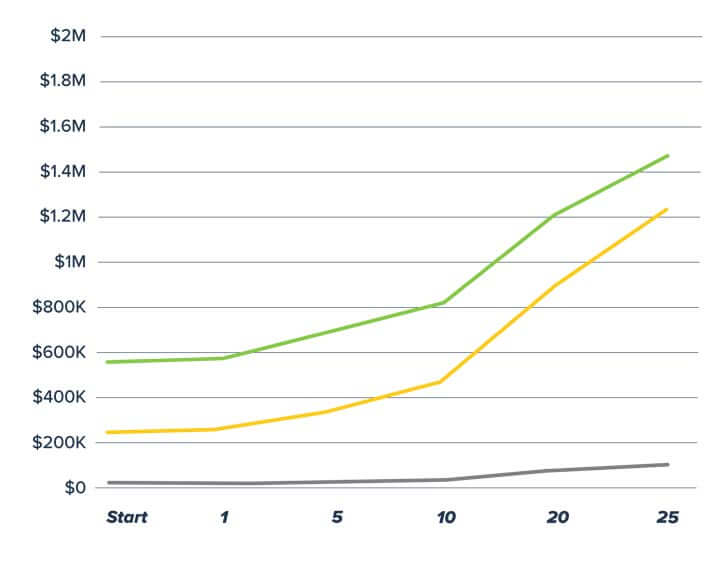

Example 2: HECM line of credit growth without a mortgage balance

- Home Value: $550,000

- Mortgage Balance: $0

- Age: 75

- Principal Limit: $243,650

- Financed Costs: MIP 2% of Home Value: $11,000 Max Origination $6,000 3rd Party Fees $4,369.20

- Expected Rate: 5.98%

- HUD MIP: 0.5%

- LOC Growth Rate: 7.26%

- Outstanding Balance: $20,744.20

- Line of Credit: $222,905.80

4% Growth Rate Calculations:

| Start | Year 1 | Year 5 | Year 10 | Year 20 | Year 30 | |

|---|---|---|---|---|---|---|

| PLF | $243,650 | $259,916 | $336,588 | $464,978 | $1,225,831 | $1,444,946 |

| Outstanding Balance | $20,744 | $22,129 | $28,657 | $39,588 | $75,549 | $104,366 |

| Line of Credit | $222,906 | $237,787 | $307,932 | $425,390 | $811,807 | $1,121,465 |

| Home Value | $550,000 | $572,000 | $669,159 | $814,134 | $1,205,118 | $1,466,210 |

HECM Line of Credit:

Home Value | Principal Limit | Outstanding Balance

Average home appreciation assumed at 1%

Average home appreciation assumed at 4%

*Information shown for illustrative purposes only. Assumptions are (1) 65-year-old borrower; (2) NJ home valued at $550,000; (3) LOC will grow at the same rate as the interest, currently (7.260%) plus the annual mortgage insurance premium charged to the loan (0.50% of the principal) for the HECM CMT MCap5 Adjustable Rate Mortgage (ARM), which uses the 1-Year CMT plus a margin of 2.00%. Initial APR is 7.260% as of 07/12/2023, which can change annually. 5% lifetime interest cap over the initial interest rate. Maximum interest rate is 12.26%; (4) no draws by the borrower. Interest rates and funds available may change daily without notice.

Sources:

- Reverse Mortgage Daily, "Senior-held home equity falls to $11.62 trillion in Q1 2023," June 2023.

- Borrowers who elect a fixed-rate loan will receive a single disbursement lump sum payment. Other payment options are available only for adjustable-rate mortgages.

- All Reverse Mortgage, if part of the loan is held in a line of credit your client can draw from. The unused portion will grow each month at a rate that's equal to the sum of the interest rate plus the annual mortgage insurance premium rate.

|

No Comments on “Unlock Your Home's Potential: In-Depth Guide to HECM Line of Credit”

|