How Reverse Mortgages Affect Heirs & Inheritance

Mike Branson Jr. – Author

Mike Branson Jr. has 25 years of experience in the mortgage banking industry. He has devoted the past 19 years to reverse mortgages exclusively. Mike has worked in several aspects of the Mortgage industry, including Loan Origination, Underwriting, and Management.A reverse mortgage allows you to live in your home for life requiring no monthly repayments. �Your benefit amount is based on borrowers� ages, property value, HUD lending limits and interest rates, not the amount you owe so you may receive only enough to pay off your existing loan on the home, but in many instances, borrowers receive a large enough benefit to pay off their existing mortgage and still give them additional funds for other uses.

Heirs Have Indirect Benefits to Reverse Mortgages

Firstly, if you need the equity or other funds to remain in place and your children are unable to assist you, it helps to relieve any burden on them to try to come up with additional funds to help you each month.

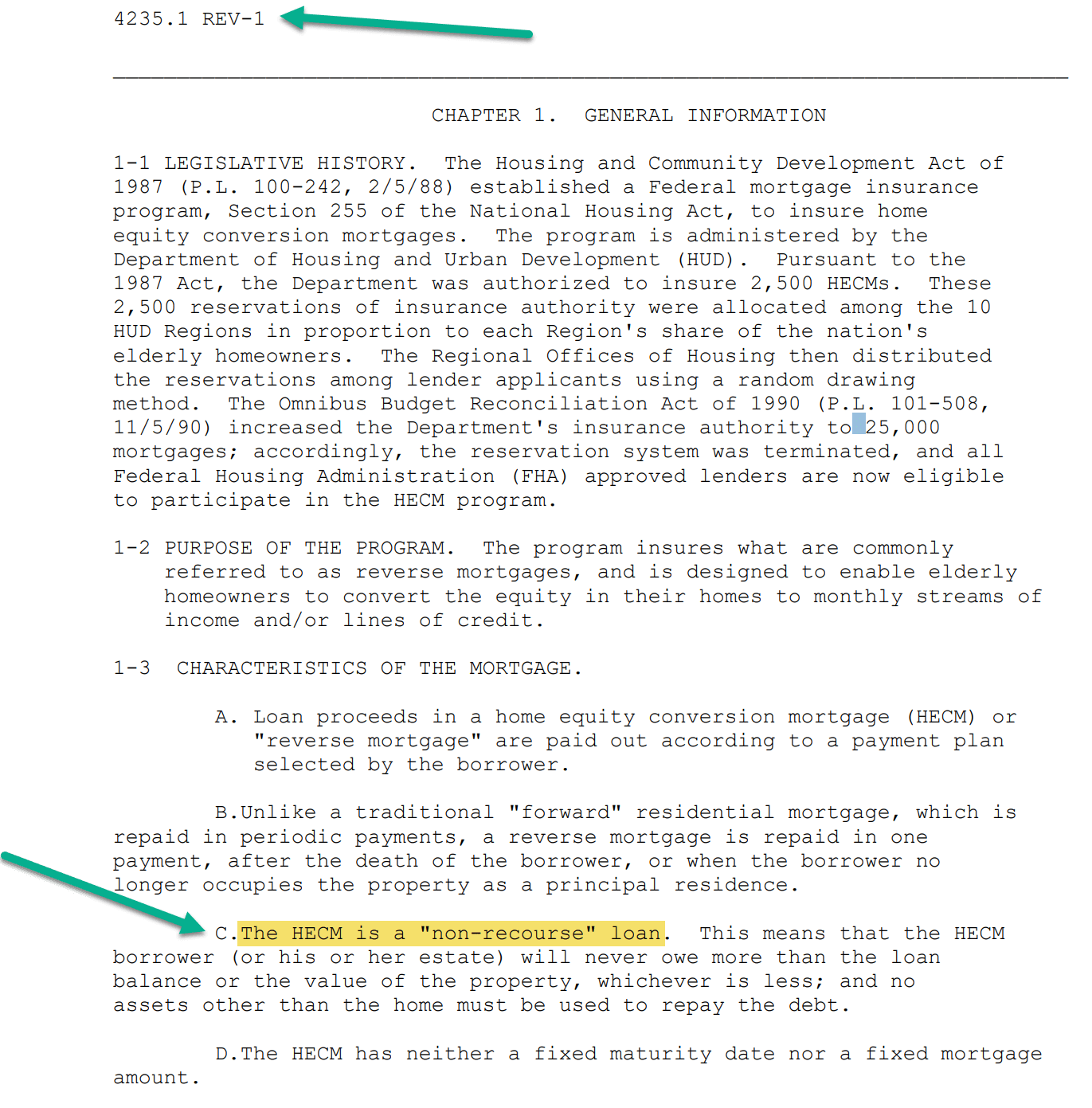

The loan allows you to live in the home payment free for life and no matter how long that is, how much you borrow, how much the reverse mortgage interest accrues or what property values do in the future, it assures heirs that they will never owe more than the property is worth.

In other words, if you pass and the balance on the loan is higher than the property value, the lender and HUD can never look to other estate assets or heirs to pay that shortfall.

Reverse Mortgages are Non-Recourse to Heirs

Source: https://www.hud.gov/sites/documents/42351C1HSGH.PDF

Heirs always have the right to keep any equity or if there is no equity, to retain the property at 95% of the current market value or the amount owed on the loan, whichever is less. This allows them to qualify for conventional financing if that is their choice and does not require them to repay an obligation totaling more than the value of the home if they want to keep it.

And if there is no one in the family that does want the house and they don�t believe it is in their best interest to sell it (no equity, etc.), they can walk away and owe nothing. However, when we hear criticism of the loan from some who have not really considered all aspects of reverse mortgages, it is usually because if you choose to get a reverse mortgage, it can lessen the amount of the asset that you leave behind to your heirs.

How Reverse Mortgage Interest Works

This is true, but no one stops to think that if you have a regular loan, that is also the case.� Any loan lowers the equity in the property and therefore, there is less inheritance to pass on to future generations. And the fact that you make no monthly payments and interest accrues raising the balance owed is another argument that asset conscious people use to criticize the loan.

However, if you review the reverse mortgage amortization schedule of any loan, you pay mostly interest in the early years of the loan and over the course of 30 years, you pay a substantial amount of interest above and beyond the principal you borrowed.

If just passing the most asset to a future generation is your goal, you should never seek any loans or debt of any kind.� Unfortunately, most of us cannot live totally debt free all our lives or purchase real estate for cash. And what most people don�t consider is that if you are able to make payments on the reverse mortgage to eliminate the balance from increasing, you can always do so at any time without penalty.

You can make payments in any amount at any time!

This means that you do not have to have an increasing balance but since there are no mortgage payments �due� at any time, if you find that your finances are such that you are not able to make a payment or only able to make a partial payment of the interest that accrued that month, there are no negative repercussions.

There are no late charges or negative credit concerns because you didn�t have a payment to make in the first place.

Reverse Mortgage Alternatives?

Another thing that many people do not consider if future generations are able to help, they can set up a family reverse mortgage to allow parents or other family members access to cash and then be repaid upon the passing of the older family members.

If you do choose this route, my suggestion would be to be sure everything is in writing so that there are no hard feelings among family members later if some run into monetary problems of their own and cannot continue to help as they first agreed or there are disagreements on the asset distributions after the repayment of funds advanced by some but not all family members.

At least with the reverse mortgage (like any other loan), the asset is sold, and you determine how all proceeds are split if you have a will or trust and there is no question about who did what.

Finally, I think that homeowners should consider a reverse mortgage for the benefits or the ramifications that it would have for them and their goals.� We strongly suggest that you discuss it with your family.

There seems to be a strong resistance at times with some in that they do not want to �bother� kids with their finances or issues but it really helps if heirs are aware of the loan in advance and what they need to do when the time comes that they have to decide to keep or sell the home.

It also really helps if the owners have their kids/heirs set up in advance with the lender so that they can speak with the lender on behalf of the loan and have all title issues resolved in advance. One good way to resolve title issues is to add children to title or to have a trust set up in advance and you should check with your family attorney to advise you in this regard.

Summary

When researching a reverse mortgage, it�s important to speak to your family and trusted financial advisor to weigh both the pros and cons. Learn more about how a HECM loan might be right for you by contacting one of our top reverse mortgage lenders,�or check your eligibility with our�free reverse mortgage calculator.

|

12 Comments on “How Reverse Mortgages Affect Heirs & Inheritance”

|

-

Admin July 8, 2021 MinaJuly 8, 2021 Our Grandmother passed away, my aunt is the heir, and my cousin wants to purchase the house. We have been told we need a real estate lawyer to open the estate to allow the sale. There is no contest. The family is all onboard with the same intention. What process is required to allow the sale? -

Admin February 22, 2022 DaynaFebruary 22, 2022 My mother passed away and was the last survivor in the home as my dad passed away a year and a half ago. We do not think we can sell the home to cover the current reverse mortgage. We have a Trust attorney and we have the home as a part of the probate process. If we walk away from the home as is would we as heirs would this affect our credit in any form? -

Admin March 17, 2022 Bettye M.March 17, 2022 What are set asides? If the homeowner pays set asides every month and does not use it, where does that money go? -

Admin June 26, 2023 DebraJune 26, 2023 My mom had a reverse mortgage, and she passed away. We are trying to sell the house; however, each of us, the heirs, received a 1099- but we did not receive any proceeds from the house. Will this 1099 affect those of my siblings that are receiving disability or social security, and why did we receive a 1099 when the proceeds went back to HUD. -

Admin June 30, 2023 Rita G.June 30, 2023 My mother had a will before getting a reverse mortgage (I think it is fixed, as described in the article comments above, i.e.). She was told at closing what happens when parents both die. They said in sum that we would be allowed six months to settle the estate or give them the keys and walk away, owing nothing! But now Mother has passed, father predeceasing her, I am the first executor in her will. Will is pretty cut and dry, leaving home to our brother(5 of us living, 4 sisters, 1 brother living, plus one brother deceased ). My dilemma is whether I should file the will, cause my brother cannot buy back the house. He does not want a house but money from us or his portion, whereas one sister wants to keep it, and 2 brothers want it! I want nothing but to keep all happy! Being brother wants nothing but to sell a house with a lien on it and no means to pay back the loan or HERM? Should I treat it like no will or file will for the sake of myself working with the lien holder? I'm just concerned if I present a will, and they learn brother won't pay it back, that lien holder will discard the rest of us and proceed to take the house from us. True or false? -

Admin July 21, 2023 Bonnie T.July 21, 2023 What would be the best solution for my sons, who are living in the house? How long would they have to stay in the house after I pass, assuming they will walk away from buying the house? The house the purchased in 1988 for $125,000, and the loan is twice that now. If the sons decide that they would like to purchase said CONDO, and the Condo is now worth $450,000, could the Sons keep the difference in equity and purchase the home with the sale proceeds? I would appreciate a reply regarding my questions. Please do not bother me with phone calls. I am merely looking into the options for the sons after I pass.Thank you